Understanding your insurance policy starts with knowing how to read the insurance declaration page, often referred to simply as the dec page. This vital document summarizes the key details of your insurance coverage, providing a snapshot of what is insured, the limits, deductibles, and important policy dates. For policyholders, mastering how to interpret this page is essential to ensure you have the right protection and avoid costly surprises during claims.

What Is the Insurance Declaration Page?

The insurance declaration page is the first page of your insurance policy packet. It acts as a summary of your entire insurance contract, outlining:

- Who is insured

- What property or risks are covered

- The amount of coverage

- Policy period and premium details

- Deductibles and limits

- Additional endorsements or riders

It is designed to be a quick reference that clearly shows the scope and cost of your insurance without needing to sift through lengthy legal jargon.

Why Reading Your Declaration Page Matters

Many policyholders overlook their declaration page, but it is arguably the most important page in your insurance policy. Here’s why:

- Confirms Your Coverage: It shows exactly what is insured and for how much.

- Reveals Policy Limits and Deductibles: Helps you understand your financial responsibility in a claim.

- Identifies Policyholders: Ensures the correct names and addresses are listed.

- Highlights Premium Costs: Shows the cost you pay for your insurance coverage.

- Alerts to Special Conditions: Any endorsements or exclusions will be noted here.

Breaking Down the Key Sections of the Declaration Page

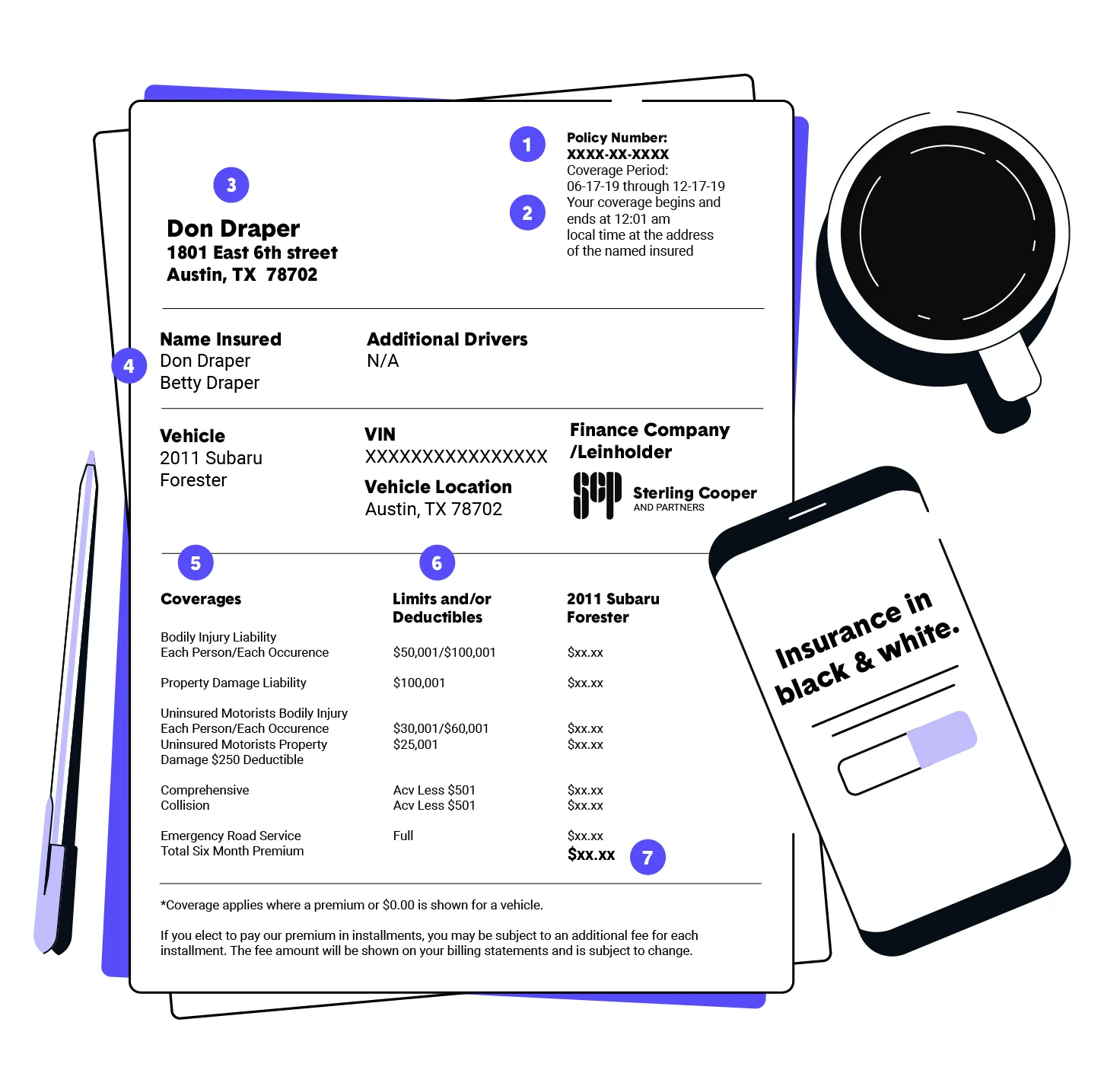

To confidently read your insurance declaration page, you need to understand its common sections. Although formats vary by insurer, the following components are standard:

1. Policyholder Information

This section includes the name and address of the insured party (individual or business). It’s crucial to verify this information is accurate to avoid claim issues.

2. Policy Number and Insurance Company

Here you’ll find the policy number, which is your unique identifier when communicating with your insurer. The insurer’s name and contact information are also provided.

3. Policy Period

This defines the effective dates of your coverage — the start and end dates of the policy term. Knowing these dates helps you understand when your protection begins and when you need to renew.

4. Coverage Summary

This section lists the types of coverage included in your policy along with coverage limits. For example, in a homeowners policy, this might include dwelling coverage, personal property, liability, and additional living expenses.

5. Coverage Limits

Each coverage listed has a limit—the maximum amount the insurer will pay for a covered loss. Understanding these limits is crucial to ensure you have enough protection for your needs.

6. Deductibles

A deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Deductibles may vary by coverage type and can impact your premium.

7. Premium Information

The premium is the cost of your insurance policy, typically shown as a total amount for the policy term. Sometimes, it breaks down by coverage.

8. Additional Coverages and Endorsements

Any endorsements, riders, or optional coverages are usually listed here. These modify or expand the standard policy, such as adding earthquake coverage or identity theft protection.

9. Mortgagee or Additional Interested Parties

If your home is financed, the mortgage lender’s information will appear on the dec page. This ensures the lender is notified of claims affecting the property.

Tips for Effectively Reviewing Your Declaration Page

- Check Accuracy: Verify names, property addresses, and coverage details.

- Review Coverage Limits: Confirm that limits are sufficient for your replacement or liability needs.

- Understand Deductibles: Higher deductibles lower premiums but increase your out-of-pocket costs.

- Look for Exclusions: Note any coverages not included or specifically excluded.

- Note Policy Period: Make sure the policy term aligns with your expectations.

- Ask Questions: If any terms or figures are unclear, contact your insurance agent for clarification.

Common Mistakes to Avoid When Reading Your Declaration Page

- Ignoring the Page Entirely: Many skip this summary, missing critical information.

- Assuming Coverage: Don’t assume all risks are covered; check for endorsements or exclusions.

- Overlooking Endorsements: Optional coverages can significantly affect your protection.

- Not Updating After Changes: Changes to your home, vehicle, or business should be reflected in an updated declaration page.

- Not Comparing Renewal Dec Pages: Coverage and premiums can change on renewal; always compare.

How the Declaration Page Works With Your Full Policy

The declaration page provides a summary, but your full insurance policy contains the detailed terms, conditions, exclusions, and claims procedures. Think of the dec page as a snapshot while the policy is the full picture. For complete understanding, review both documents carefully.

By mastering how to read your insurance declaration page, you empower yourself to manage your insurance more effectively, confirm you have the protection you need, and avoid unpleasant surprises. Always keep a copy accessible, review it regularly, and consult your agent whenever in doubt.